Hey Recyclersteve, MSTR of no interest to you?

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

pmbug wrote:FWIW:Saylor's ship is sinking, -$10 after hours

The toxic convertible bonds should begin triggering soon, diluting the stock like 2000 when it fell from $333 to 0.45¢

...Dec 1999 $MSTR sold convertible bonds with maturity in 2005 exactly like today. When the stock price fell 3 months later the bonds converted into shares

Everyone thought Michael Saylor was a genius before the stock collapsed from $333 to 0.45¢

See you on Feb 19 Michael Saylor

https://x.com/FinanceLancelot/status/18 ... 5972010105

Meanwhile, 3 months later...MSTR's demise has not been predicted as often as BTC's. However, like BTC doomsayers, most haters don't have a clue.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR hit a high of $543 in November 2024.

Now the stock price is $370 six months later.

https://www.cnbc.com/quotes/MSTR

Now the stock price is $370 six months later.

https://www.cnbc.com/quotes/MSTR

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

The journey of a thousand miles begins with a single step. -Lao Tzu

You can find me ranting at clouds on pmbug.com.

You can find me ranting at clouds on pmbug.com.

-

pmbug - Penny Collector Member

- Posts: 368

- Joined: Sat Dec 10, 2011 4:00 pm

- Location: Uncle Scrooge's Vault

Re: Hey Recyclersteve, MSTR of no interest to you?

Caveat venditor. One might miss out.

$MSTR has a market cap of $101 Billion. The value of Mr. Patten's shares are, in comparison, a drop in the bucket. Besides, he has also filed to exercise and receive some stock options for his service as director. Your warning should tell us why he's selling because people sell stuff all the time, even PMs.

$MSTR has a market cap of $101 Billion. The value of Mr. Patten's shares are, in comparison, a drop in the bucket. Besides, he has also filed to exercise and receive some stock options for his service as director. Your warning should tell us why he's selling because people sell stuff all the time, even PMs.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

If you haven’t been following along $MSTR ponzinomics here’s a summary…

1. $MSTR survives as a fake Bitcoin ETF in a market full of actual Bitcoin ETFs because it trades at a 2x+ premium to the value of its Bitcoin…for reasons (Half due to some institutional regulations…half bc it’s a cult)

2. But Saylor has had to issue/sell so many new shares of $MSTR to keep buying Bitcoin at the top, that NAV premium has been tanking from dilution

3. If the NAV premium collapses, so does the $MSTR share price

4. So Saylor creates 2 Preferred share structures called $STRK & $STRF to raise more cash to buy Bitcoin without direct dilution of $MSTR common stock, hoping to boost NAV premium

5. These shares are supposedly backed by the same Bitcoin as $MSTR, convertible to $MSTR, and pay a high annual dividend

6. $MSTR as a business doesn’t generate cash flow, so those dividends must be paid by either selling/granting $MSTR common shares, or selling Bitcoin……so they’re still dilutive

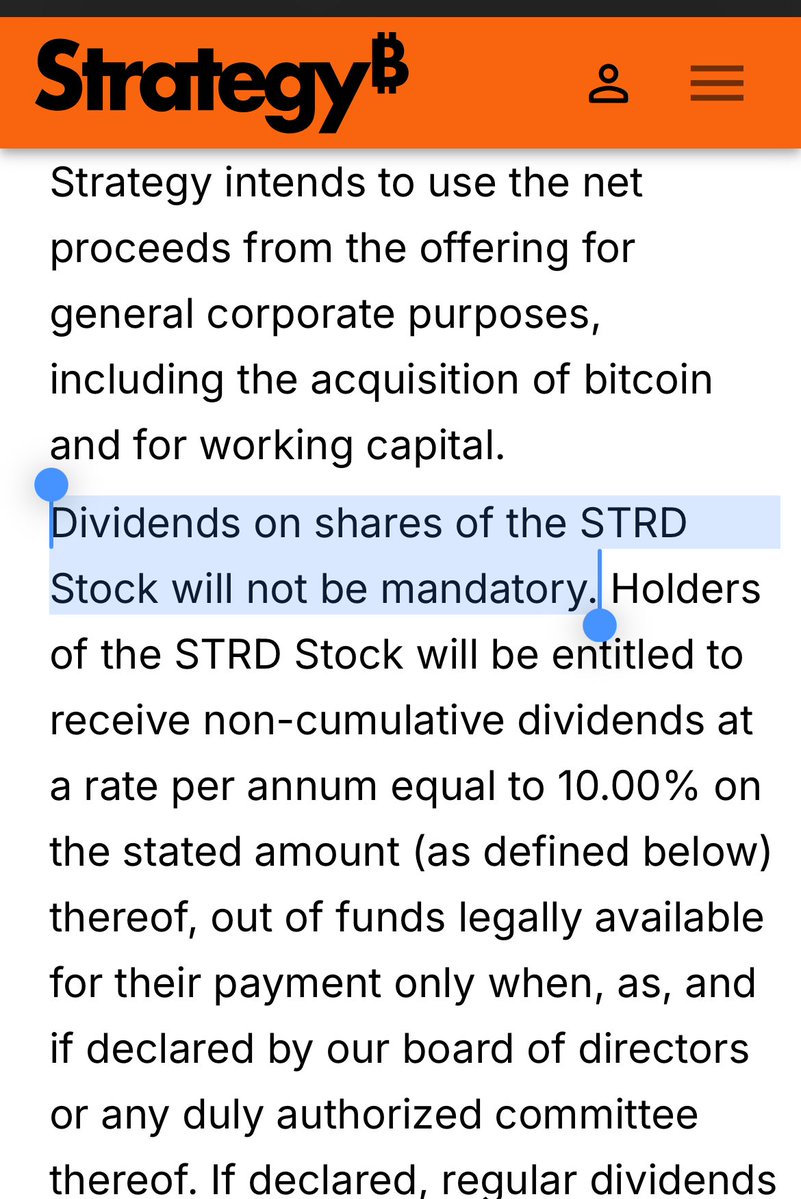

7. Since he hasn’t been able to sell enough $STRK and $STRF to support the NAV, Saylor just created a 3rd preferred called $STRD, which also grants a dividend, but doesn’t have any guarantees it will be paid

8. $STRD will likely trade with a higher yield due to the increased risk. Saylor says it also will be used for $MSTR share buybacks if the NAV falls too low

9. $MSTR have created a massive tower of diluting leverage, all supposedly backed by the same pool of assets, to continue to raise capital from a shrinking pool of cash to buy Bitcoin

10. The only way this tower can stay standing is if Bitcoin (and $MSTR price) keeps going up, and Saylor can keep buying Bitcoin.

If the money stops flowing in…

ie..it’s the biggest publicly traded Ponzi Scheme of all time

https://x.com/RhoRider/status/1929770291368255839

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

From STRF to STRD — is Michael Saylor just selling junk bonds?

https://protos.com/from-strf-to-strd-is ... k-bonds-1/

Some followers of Michael Saylor have grown tired of his alliterative naming convention for a ballooning series of MicroStrategy (MSTR) preferred shares.

After Strike, Strife, and now Stride, some shareholders just want to call a spade a spade. Indeed, according to several investors, his latest preferreds should be simply junk bonds.

Saylor characterized Stride (STRD) as perpetual preferred stock with $100 of liquidation preference paying non-cumulative dividends at 10%.

https://protos.com/from-strf-to-strd-is ... k-bonds-1/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Saylor prices his latest $STRD trash bond at $85 ($100 par)

It pays 10% dividend…except with this POS they can just choose to not pay at all with 0 penalty

So for just $85 you buy rights to $10 dividend paid from nonexistent cash, you‘ll probably never get! Sign me up!

https://x.com/RhoRider/status/1930989640577962037

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Microstrategy has issued three versions of preferred stock lately. Their differences explained:

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Saylor buys more $BTC with only preferred stock vs $MSTR common ATM

Last year his avg Bitcoin buys were $600m-$2B+. The last 2 were just <$200M total

He can’t hit $MSTR ATM without killing mNAV, but the preferreds are far less liquid

His cash tank is getting low

https://x.com/RhoRider/status/1932133379807617300

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

New lawsuit accuses MicroStrategy of 'misleading' shareholders

https://www.thestreet.com/crypto/market ... misleading

On June 10, Levi & Korsinsky, LLP announced a class action lawsuit against MicroStrategy Incorporated.

Investors who had purchased stock in the company from the end of April 2024 through the beginning of April 2025 were invited to register their intent to seek recompense for alleged financial damages. The lead plaintiff registration cutoff is set for July 15.

The official complaint said that Strategy (previously MicroStrategy) management intentionally misled shareholders regarding the true profitability and risks associated with their Bitcoin-centric investment plan, while downplaying the immense volatility inherent in the cryptocurrency's market valuation.

For the first quarter of 2025 financials, Strategy adopted Accounting Standards Update No. 2023-08 for evaluating future adjustments on crypto assets, as the market price reported an unrealized loss of $5.91 billion.

Upon releasing interim corporate statements on April 7, Strategy stock plunged 8.7% as investors reacted to the substantial impairment, closing at $268.14 per share.

Just weeks later, on May 1, the firm acknowledged a loss of nearly $6 billion stemming directly from Bitcoin's massive price drop and the growing uncertainty surrounding future earnings generated through such risky assets.

https://www.thestreet.com/crypto/market ... misleading

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Another way to think about $MSTR / $STRD yield dilemma -> Imagine a guy who was previously convicted of fraud and once crashed the entire stock market, offers to sell you a paper ticket that he says will pay you $10 per year

He is deep in debt, has negative income, and the ticket’s fine print says he can just choose not pay you at all if he wants.

BUT he has a big pile of magic beans in the bank, and he promises the future gain in value of those beans will enable him to sell infinitely more tickets to pay all ticket holders the $10.

How much would you be willing to pay for the ticket?

https://x.com/RhoRider/status/1932881809559486820

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

tdtwedt wrote:Another way to think about $MSTR / $STRD yield dilemma -> Imagine a guy who was previously convicted of fraud and once crashed the entire stock market, offers to sell you a paper ticket that he says will pay you $10 per year

He is deep in debt, has negative income, and the ticket’s fine print says he can just choose not pay you at all if he wants.

BUT he has a big pile of magic beans in the bank, and he promises the future gain in value of those beans will enable him to sell infinitely more tickets to pay all ticket holders the $10.

How much would you be willing to pay for the ticket?

https://x.com/RhoRider/status/1932881809559486820

As the price of the ticket goes up (share price), fewer people are willing to buy it. So he must keep making new ticket types that either sell cheaper or promise a bigger payment %.

But with each new ticket, his payment obligation increases, along with risk he won’t pay…so investors demand ever lower prices / higher % payments

This goes on until non payment risk is so high. nobody is willing to buy the tickets anymore, and current ticket holders rush to dump theirs with no more payments coming in

https://x.com/RhoRider/status/1932881812696764685

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Michael Saylor. @saylor

On @BloombergTV

I explain $STRK, $STRF, $STRD, the risk of shorting $MSTR, the rise of Bitcoin Treasury Companies, our 100% BTC @Strategy, debunk Quantum FUD, and show why AI is bullish for Bitcoin. <end quote>

20 minute video at the link of Saylor on BloombergTV. Worth it!

https://x.com/saylor/status/1932485145464021158

Buy some BTC and make the price go higher. Or, alternatively, don't buy any so I can continue to buy at current low prices.

On @BloombergTV

I explain $STRK, $STRF, $STRD, the risk of shorting $MSTR, the rise of Bitcoin Treasury Companies, our 100% BTC @Strategy, debunk Quantum FUD, and show why AI is bullish for Bitcoin. <end quote>

20 minute video at the link of Saylor on BloombergTV. Worth it!

https://x.com/saylor/status/1932485145464021158

Buy some BTC and make the price go higher. Or, alternatively, don't buy any so I can continue to buy at current low prices.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR hit a high of $543 in November 2024.

Now the stock price is $385 seven months later.

https://www.cnbc.com/quotes/MSTR

Now the stock price is $385 seven months later.

https://www.cnbc.com/quotes/MSTR

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

There's some important news around MSTR. The info will be so much more meaningful if you do your own homework. And the following, announced today, is not the news I'm talking about, although their avg. BTC cost is something to crow about.

Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 billion at ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD

Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 billion at ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

As predicted, Saylor has just resorted to $0.5B+ in common stock dilution again to buy Bitcoin after failing to scale enough new liquidity via preferred shares

https://x.com/RhoRider/status/1939736334882750487

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Michael Saylor keeps diluting MSTR holders after preferred sale flops

https://protos.com/michael-saylor-keeps ... ale-flops/

MicroStrategy’s latest Securities and Exchange Commission filing discloses that the company has already returned to its old strategy of dumping common stock and directly diluting its shareholders.

Via these at-the-market (ATM) offerings, the company sold 1.3 million MSTR from June 23-29 to raise $519.5 million.

Even if all of this money goes directly to buy BTC, shareholders are directly diluted from these ATMs and therefore experience no immediate benefit.

https://protos.com/michael-saylor-keeps ... ale-flops/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Strategy snaps weekly purchase streak

https://www.cryptopolitan.com/strategy- ... -btc-gain/

This time around, the leading treasury company paused its weekly BTC purchases for the first time since early April.

The three-month streak for Strategy once again raised questions about its MSTR stock dilution and the issuance of its alternative convertible shares. On Sunday, executive chairman Michael Saylor hinted at no new purchases this week.

https://www.cryptopolitan.com/strategy- ... -btc-gain/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Stack Hodler @stackhodler

I bought MSTR yesterday.

I'm not a market timer. And I'm not a trader.

I only buy assets that I'm comfortable holding forever because I don't want to stress about entries and exits.

So why did I buy MSTR? And why now?

A few basic reasons:

1. MSTR has an unassailable lead in the corporate treasury race.

No one will catch them without making the BTC price run away in the process.

And I believe the largest corporate holder of BTC will have unique (and valuable) opportunities in the future.

2. The vast majority of the world still doesn't believe in Bitcoin.

Even fewer understand why Bitcoin treasury companies have value.

Which means the majority is still discounting just how valuable Strategy's balance sheet will become.

3. MSTR has proven that it's the leader at engineering conduits for poorly allocated capital to find its way into Bitcoin (by way of Strategy's balance sheet).

I'm bullish on

@Saylor

finding clever ways to pull in more of the fixed income market, and then down the road, finding ways to generate value from their BTC holdings.

I setup my Coinbase account in 2013.

I had many smart people tell me to buy in 2015.

And I finally bought BTC in 2017.

And when I was backing up the truck in 2019 and 2020 I considered myself "late" to Bitcoin.

This feels similar.

I've seen many people I respect buy Strategy much earlier than me.

I remained skeptical of what I was witnessing.

And I don't like to buy things unless I feel certain.

But I've now seen enough evidence that holding MSTR is an intelligent way to express a very bullish view on Bitcoin over the long run.

If you think BTC is going to $1 million+, then it's not a stretch to think that the largest corporate holder of BTC has a chance to become one of the most valuable companies in the world.

Just like BTC, MSTR has been trading in this price range for 9 months.

It's trading at the same price it hit in November 2024, but with significantly more Bitcoin on its balance sheet.

And as I believe BTC is ready to break out into price discovery, I decided now was the time to pull the trigger.

There's a huge caveat here.

I bought MSTR in a retirement account.

With the rise of BTC treasury companies, many people are losing sight of the unique value of cold-stored Bitcoin.

Treasury company equities have counter-party risk.

They have management execution risk.

Key man risk. Jurisdictional risk. Dilution risk.

They require a level of trust that Bitcoin doesn't.

They are not a substitute for real Bitcoin, especially not at this point of the Big Debt Cycle.

I'm still stacking "physical" Bitcoin with my personal after-tax cashflows.

I'm not buying anything else.

If you're still early on your Bitcoin journey, don't lose focus.

You should be stacking point-ones as rapidly as possible.

One whole Bitcoin is out of reach for most.

But it's still in sight for the truly ambitious, industrious, and focused hodler.

But not for much longer.

I bought MSTR yesterday.

I'm not a market timer. And I'm not a trader.

I only buy assets that I'm comfortable holding forever because I don't want to stress about entries and exits.

So why did I buy MSTR? And why now?

A few basic reasons:

1. MSTR has an unassailable lead in the corporate treasury race.

No one will catch them without making the BTC price run away in the process.

And I believe the largest corporate holder of BTC will have unique (and valuable) opportunities in the future.

2. The vast majority of the world still doesn't believe in Bitcoin.

Even fewer understand why Bitcoin treasury companies have value.

Which means the majority is still discounting just how valuable Strategy's balance sheet will become.

3. MSTR has proven that it's the leader at engineering conduits for poorly allocated capital to find its way into Bitcoin (by way of Strategy's balance sheet).

I'm bullish on

@Saylor

finding clever ways to pull in more of the fixed income market, and then down the road, finding ways to generate value from their BTC holdings.

I setup my Coinbase account in 2013.

I had many smart people tell me to buy in 2015.

And I finally bought BTC in 2017.

And when I was backing up the truck in 2019 and 2020 I considered myself "late" to Bitcoin.

This feels similar.

I've seen many people I respect buy Strategy much earlier than me.

I remained skeptical of what I was witnessing.

And I don't like to buy things unless I feel certain.

But I've now seen enough evidence that holding MSTR is an intelligent way to express a very bullish view on Bitcoin over the long run.

If you think BTC is going to $1 million+, then it's not a stretch to think that the largest corporate holder of BTC has a chance to become one of the most valuable companies in the world.

Just like BTC, MSTR has been trading in this price range for 9 months.

It's trading at the same price it hit in November 2024, but with significantly more Bitcoin on its balance sheet.

And as I believe BTC is ready to break out into price discovery, I decided now was the time to pull the trigger.

There's a huge caveat here.

I bought MSTR in a retirement account.

With the rise of BTC treasury companies, many people are losing sight of the unique value of cold-stored Bitcoin.

Treasury company equities have counter-party risk.

They have management execution risk.

Key man risk. Jurisdictional risk. Dilution risk.

They require a level of trust that Bitcoin doesn't.

They are not a substitute for real Bitcoin, especially not at this point of the Big Debt Cycle.

I'm still stacking "physical" Bitcoin with my personal after-tax cashflows.

I'm not buying anything else.

If you're still early on your Bitcoin journey, don't lose focus.

You should be stacking point-ones as rapidly as possible.

One whole Bitcoin is out of reach for most.

But it's still in sight for the truly ambitious, industrious, and focused hodler.

But not for much longer.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR hit a high of $543 in November 2024.

Now the stock price is $412 eight months later.

https://www.cnbc.com/quotes/MSTR

Now the stock price is $412 eight months later.

https://www.cnbc.com/quotes/MSTR

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Can we get a welfare check on Recyclersteve?

Last visited RC: Sat Jun 28, 2025 5:52 pm

Last visited RC: Sat Jun 28, 2025 5:52 pm

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

Michael Saylor dumped MSTR, STRF, STRK, STRD for latest bitcoin buy

https://protos.com/michael-saylor-dumpe ... tcoin-buy/

For the first time ever, MicroStrategy admitted that over the course of a single week, it diluted all four classes of the company’s public securities.

The company made $472 million in net proceeds by dumping shares of MSTR, STRK, STRF, and STRD at-the-market (ATM). By immediately diluting prior shareholders in each category, the company then bought the same amount of BTC.

https://protos.com/michael-saylor-dumpe ... tcoin-buy/

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Re: Hey Recyclersteve, MSTR of no interest to you?

Wake up! Michael Saylor @saylor

$MSTR just closed at an all-time high market cap.

Even Stevie Wonder can see why MSTR is doing so well. Might have something to do with them owning 601,550 Bitcoin. Maybe. Don't want to go out on a limb.

$MSTR just closed at an all-time high market cap.

Even Stevie Wonder can see why MSTR is doing so well. Might have something to do with them owning 601,550 Bitcoin. Maybe. Don't want to go out on a limb.

If you want some free Bitcoin, I can show you how to get it.

-

shinnosuke - Too Busy Posting to Hoard Anything Else

- Posts: 4335

- Joined: Mon Feb 14, 2011 7:10 pm

- Location: Texas

Re: Hey Recyclersteve, MSTR of no interest to you?

MSTR hit a high of $543 in November 2024.

Now the stock price is $458 eight months later.

https://www.cnbc.com/quotes/MSTR

Now the stock price is $458 eight months later.

https://www.cnbc.com/quotes/MSTR

There are more ways than one to skin a cat.

-

tdtwedt - 1000+ Penny Miser Member

- Posts: 1183

- Joined: Tue Jan 13, 2015 9:22 pm

- Location: South Mississippi

Return to Economic & Business News, Reports, and Predictions

Who is online

Users browsing this forum: No registered users and 27 guests