The crypto community was left disappointed as MicroStrategy (Nasdaq: MSTR) couldn't join the S&P 500 list after the rebalance on Sep. 5.

...

https://www.thestreet.com/crypto/market ... -rebalance

The crypto community was left disappointed as MicroStrategy (Nasdaq: MSTR) couldn't join the S&P 500 list after the rebalance on Sep. 5.

...

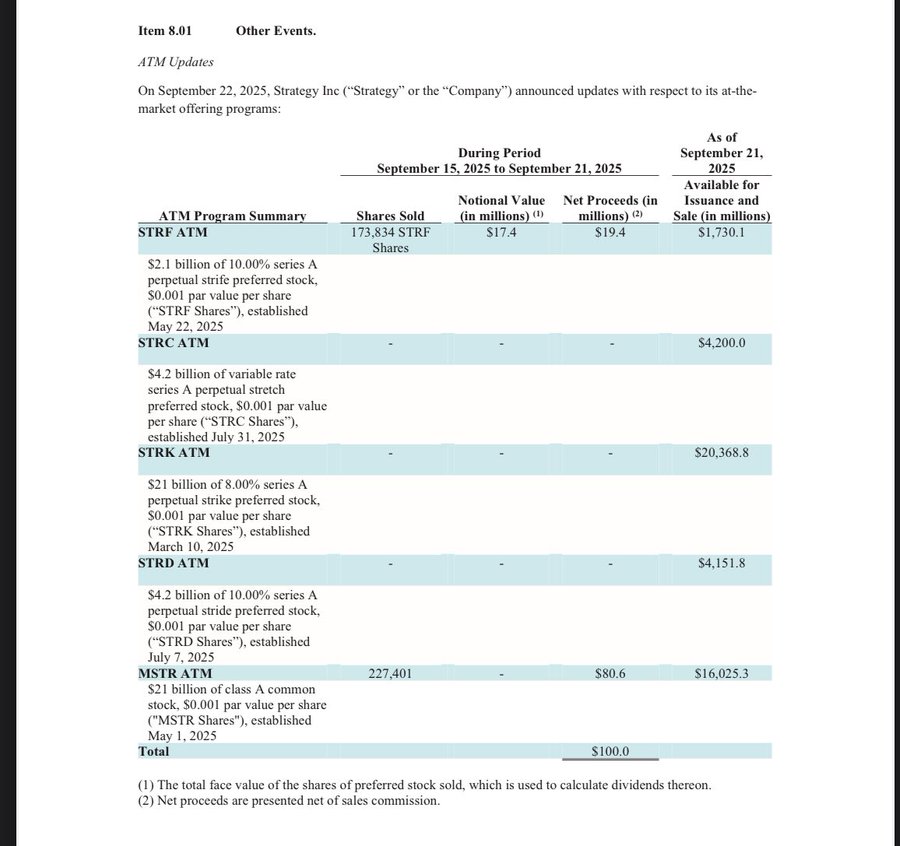

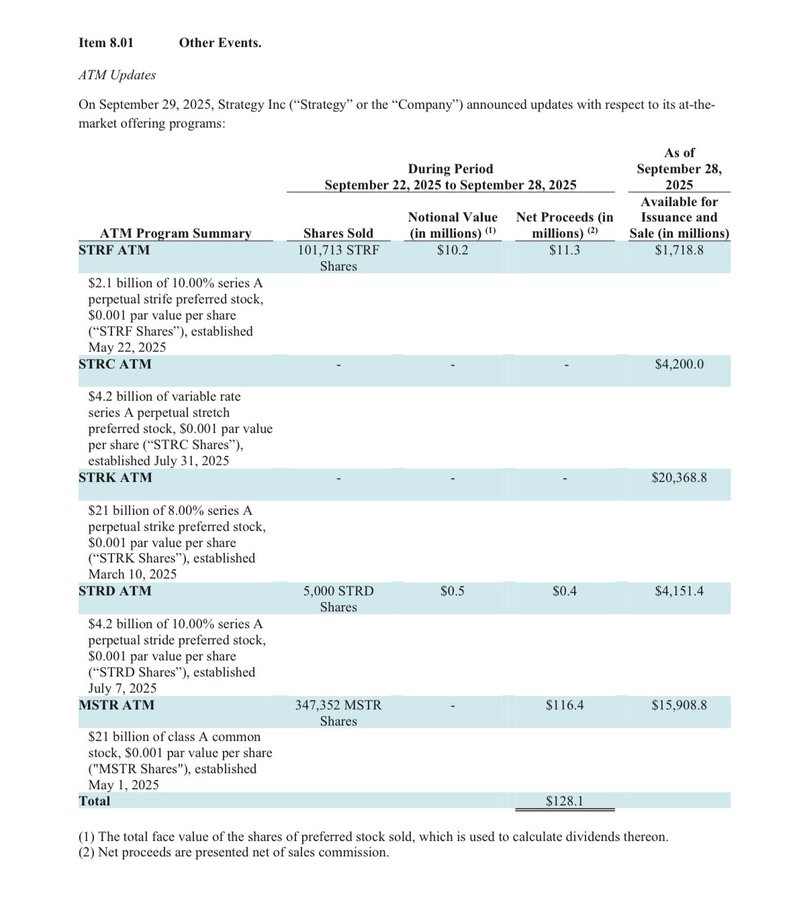

Once again, Saylor massively dilutes common stock holders for $200M as the Ponzi Preferreds run dry

Strategy (formerly MicroStrategy), along with the rest of the crypto treasury industry, got spooked last week after Nasdaq issued new rules about selling stock to buy digital assets.

Unlike traditional enterprises that aim to profit by selling goods or services, crypto treasury companies primarily buy crypto on leverage by selling corporate debt, equities, and derivatives.

Exchange officials are looking to tighten listing requirements for such companies.

Apparently anybody critical of Saylor once again diluting $MSTR common stock holders to buy the pico Bitcoin top in possibly the worst capital management scheme in the history of public companies…is a bot

Despite hundreds of millions of dollars worth of Strategy purchases by institutional wealth managers overseeing trillions of dollars, its MSTR common stock is languishing 38% below its 52-week high.

Since the end of the second quarter of 2025 when many funds disclosed their purchases, MSTR has lost $8 billion in market cap despite these impressive inflows.

Saylor *forgot* to mention, despite only buying $22M $BTC this week they actually diluted shareholders for $128M (mostly $MSTR commons)

The rest will pay the ponzi preferred share dividends due tomorrow

Notably he also sold shares of preferreds to pay preferred dividends

This morning, Strategy founder Michael Saylor announced more bitcoin (BTC) purchases funded from direct dilution of his MSTR shareholders.

Despite MSTR’s underperformance relative to BTC, Saylor has refused to reinstate the July 31 ban on common share dilution.

Return to Economic & Business News, Reports, and Predictions

Users browsing this forum: No registered users and 25 guests